Formation of a company in Germany – which legal form?

The German GmbH is probably the most known legal entity abroad. But, what differences in legal entities are there?

Before the actual founding process begins, it must first be clarified which legal form is the most suitable. The decisive factor here is, who will be the shareholder of the German company. There are different options for private owners than for companies.

1. Foundation by a British company

In case the founder is a British company, it has the possibility to either set up a subsidiary in Germany, or to found a German company with its own legal presence.

Does the British company merely have the set up of a subsidiary in mind, then there are two possibilities: the one of an independent subsidiary (“selbständige Zweigniederlassung”) or the other possibility of a dependent subsidiary (“unselbständige Zweigniederlassung” or “Betriebsstätte”).

However, does the British company prefer founding a German legal entity, various legal forms are possible. The most common legal form is the “GmbH”. The bigger “AG” is for most SMEs not an option, due to its high foundation costs and also the running costs are much higher compared to a GmbH. For the UG, the minimum capital is one euro only. This on the one hand represents a low entry hurdle, but on the other hand has contributed to an extremely poor image of the UG, which is why INDIPA does not support the establishment of a UG.

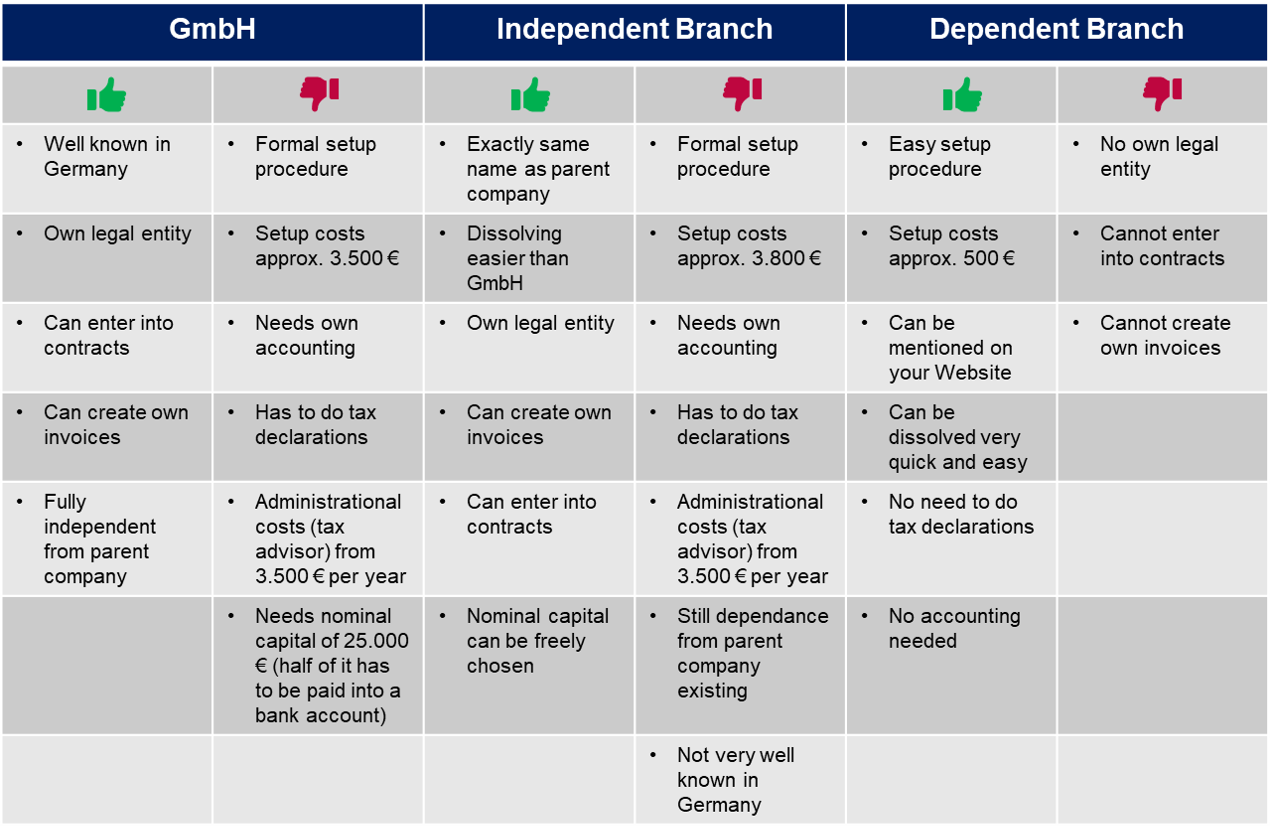

Here is an overview of the three most common types of foreign company establishment described above:

The GmbH (company with limited liability)

The GmbH is comparable to the Ltd. A GmbH is not publicly owned, but the shares are privately held. Hence, the shares are not freely tradeable. The shareholder benefits from a limited liability. To set up a GmbH, a starting capital of at least € 25,000 is required. Of this € 25,000, at least half has to be deposited at the time of the foundation (normally paid into a bank account).

The GmbH is formed in presence of a notary and is based on a formal deed of formation (“Gesellschaftsvertrag”), in which e. g. place of business, business purpose, shareholders and directors are mentioned.

2. Foundation by an independent entrepeneur

If the founder is a private person, the company-form can be a GmbH, a UG, an AG, and also a sole proprietorship (“Einzelunternehmen”). The significant difference between a GmbH and a sole proprietorship is, that the founder of a sole proprietorship is liable with all its personal assets. A further difference is, that a sole proprietorship does not require the foundation executed by a notary, and no starting capital of 25,000 € is required. Also an “Einzelunternehmen” has to be a real person, meaning that an “Einzelunternehmen” cannot be formed or exist out of a company.

If the founder is a private person, the company-form can be a GmbH, a UG, an AG, and also a sole proprietorship (“Einzelunternehmen”). The significant difference between a GmbH and a sole proprietorship is, that the founder of a sole proprietorship is liable with all its personal assets. A further difference is, that a sole proprietorship does not require the foundation executed by a notary, and no starting capital of 25,000 € is required. Also an “Einzelunternehmen” has to be a real person, meaning that an “Einzelunternehmen” cannot be formed or exist out of a company.

The sole proprietorship must be registered in the town where it has its place of business. As the sole proprietorship is directly linked to the business owner, they should genuinely carry out their business at the registered office and should be mainly on-site there. No obligation exists to enter the sole proprietorship in the trade register, however, it is possible. In case of registration, the company name would be supplemented with “e.K.” (“eingetragener Kaufmann”/registered sole trader) . This gives a reliable and professional impression.

INDIPA’s role

Please contact us here, in case you have any questions regarding the foundation of a company in Germany. Or just continue reading here, to see how INDIPA can support you in setting up your German company.

Knowledge hub

Your contact person

For all questions regarding the German market, please contact Christoph!

References

“INDIPA has been fantastic in helping us to set up a GmbH and everything that goes with it! The team has been fast, professional and a good support in such an important step. We recommend INDIPA to anyone who wants to take a leap onto the German market!”

“We have been active in the German market since 2005. Even though we speak good German and are located near the border we were looking for a German point of contact for our customers. Setting up a German subsidiary would have been too expensive at that point in time, which is why we contacted INDIPA. The costs of the services are always fair and comprehensive. We would not hesitate to recommend INDIPA!”

“Before entering the German market with our company, we heard many stories about the difficulties and necessary paperwork that would be needed.

The best choice we made was to hire INDIPA to help us with our start in Germany. They guided us perfectly through all procedures and made things very easy for us to get started.”

“Thanks to INDIPA our German Helpdesk is always available. The INDIPA staff have extensive knowledge of our company and our products and can therefore provide our customers with excellent advice over the telephone.”

“INDIPA organises our complete German customer service, including inside sales. INDIPA is integrated into our own organisation and contributes to the professional image we like to have. It is impressive how flexible and yet professional INDIPA is. We hesitated for a long time before deciding to work with them. The cooperation has led to strong growth in sales in Germany and neighbouring countries, and the success we are having proves that we made the right decision!”

Weather and local time

Reviews

4.9 32 reviews